Roadmap for Banking of the Future

Current Affairs 10 September 2021

Daily Current Affairs 10 September 2021: This post contains the latest current affairs for 10 September 2021 that are important for all competitive exams like Bank, SSC, IBPS, SBI exams. You can also attempt our Current Affairs Quiz after reading our daily current affairs.

Ranking

IIT Madras Retains Top Spot in Overall Category of NIRF India Ranking 2021

- The Union Minister of Education, Shri Dharmendra Pradhan released the NIRF India Rankings 2021, on September 09, 2021 through video conferencing.

- Overall Winner: The Indian Institute of Technology (IIT) Madras has retained the top spot in overall category.

- The NIRF India Rankings 2021 is the sixth edition of the annual list which ranks higher educational institutions in the country based on objective criteria to promote competitive excellence.

List of Winners

- Overall – Indian Institute of Technology Madras (IIT Madras)

- University – Indian Institute of Science, (IISc) Bangaluru

- Management – Indian Institute of Management (IIM) Ahmedabad

- College – Miranda House, Delhi

- Pharmacy – Jamia Hamdard, New Delhi

- Medical – All India Institute of Medical Sciences (AIIMS) Delhi

- Engineering -Indian Institute of Technology (IIT), Madras

- Architecture – Indian Institute of Technology, Roorkee

- Dental – Manipal College of Dental Sciences, Udupi

- Law – National Law School of India University (NLSUI), Bengaluru

- Research Institutions – Indian Institute of Science, (IISc) Bangalore

National

CBDT sets up 3 Boards for Advance Rulings (BAR) to fast-track tax disputes

- The Central Board of Direct Taxes (CBDT) has constituted three Boards for Advance Rulings (BAR), to ensure faster disposal of cases and avoid income tax disputes.

- The BARs have been made operational from September 01, 2021.

- Out of the three BARs, two have been set up in Delhi and one in Mumbai.

- Each BAR shall consist of two members, each being an officer not below the rank of Chief Commissioner.

- These BARS will replace Authority for Advance Rulings (AAR), which was set up in 1993, to avoid dispute in respect of assessment of tax liability and to provide tax certainty.

- Key difference between AAR and BAR: AAR rulings were binding both on the applicants and the Tax department. However advance rulings of BAR shall not be binding on the applicant or the Department and either of them may appeal against the ruling or order passed by the Board before the High Court.

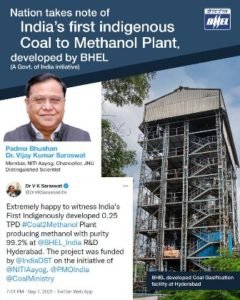

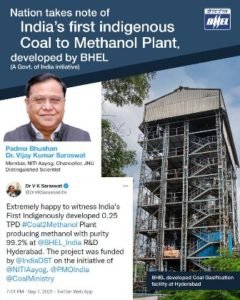

India’s first Indigenously Designed High Ash Coal Gasification Based Methanol Production Plant inaugurated at BHEL R&D Centre, Hyderabad

- The first-ever, indigenously designed High Ash Coal Gasification Based Methanol Production Plant, in India has been inaugurated at BHEL R&D centre at Hyderabad.

- The project was funded by the Department of Science and Technology, which provided a Rs 10 crore grant, at the initiative of NITI Aayog, PMO-India and the Ministry of Coal.

- The facility can create 0.25 ton per day (TPD) Methanol from high ash Indian coal using a 1.2 TPD Fluidized bed gasifier.

- The purity of the crude methanol produced is between 98 and 99.5 percent.

- The demonstration plant was inaugurated on September 08, 2021 in the presence of Dr V K Saraswat, member of NITI Aayog, Sh. Nalin Shinghal, Chairman BHEL along with BHEL’s Coal Gasification team.

Committee

Centre Forms Panel To Frame New Law For Drugs, Cosmetics, Medical Devices; Head – Dr VG Somani

- The Ministry of health and family welfare has constituted an eight-member expert committee for framing new laws for drugs, cosmetics and medical devices and replace the existing Drugs and Cosmetics Act, 1940.

- The committee will be chaired by Drugs Controller General of India (DCGI) Dr VG Somani.

- The Drugs and Cosmetics Act, 1940 regulated only the import, manufacture, distribution and sale of drugs and cosmetics. The new Drugs, Cosmetics and Medical Devices Act will incorporate regulation of medical devices as well.

Banking & Economy

RBI allows tokenization in Card-on-File services

- The Reserve Bank of India has made the following two enhancements in the card tokenization services:

- First: the device-based tokenization framework will now be applicable to Card-on-File Tokenisation (CoFT) services as well. Card-on-File (CoF) means that the Credit/Debit card details are stored by merchants for ease of payment. However, since storing card details online could be dangerous since there is a possibility of data hacking, RBI has now allowed tokenization of Card-on-File (CoF), i.e. the original card details will not be stored by the merchant and card details will be stored in token form.

- Second: RBI has allowed card issuers (banks) to offer card tokenization services as Token Service Providers (TSPs). The tokenization of card data shall be done with explicit customer consent requiring an Additional Factor of Authentication (AFA).

- Token Service Provider (TSP) refers to the entity which tokenizes the actual card credentials and de-tokenizes them whenever required. Earlier only card networks (like VISA, Mastercard) were allowed to act as TSPs. So now banks can act as TSPs.

RBI takes UCO Bank out of PCA Framework

- The Reserve Bank of India has announced that UCO Bank is taken out of the PCA restrictions. (Prompt Corrective Action Framework (PCAF))

- RBI said that as per the published results for the year ended March 31, 2021, UCO bank is not in breach of the PCA parameters.

- The Reserve Bank has specified certain regulatory trigger points, as a part of prompt corrective action (PCA) Framework, in terms of three parameters, i.e. capital to risk-weighted assets ratio (CRAR), net non-performing assets (NPA) and Return on Assets (RoA). These should be maintained by banks.

Bank of Baroda’s launches digital platform ‘bob World’

- Bank of Baroda has announced the launch of its digital banking platform named ‘bob World’. The aim of the platform is to provide all banking services under one roof.

- The pilot test of the platform began on August 23, 2021. More than 220 services will be converged into this one single app.

RBI approves re-appointment of V. Vaidyanathan as MD & CEO of IDFC FIRST Bank

- The Reserve Bank of India (RBI) has granted its approval for re-appointment of V. Vaidyanathan as the Managing Director & Chief Executive Officer (‘MD & CEO’) of the IDFC First Bank.

- Mr. Vaidyanathan has been appointed for a further period of three years, which will be effective from December 19, 2021.

- He first took charge as the MD & CEO of IDFC FIRST Bank in December 2018, after the merger of IDFC Bank and Capital First.

Insurance

Govt appoints 10 merchant bankers for managing IPO of LIC

- The government of India has appointed 10 merchant bankers for managing the Initial Public Offering of Life Insurance Corporation of India (LIC). The IPO of LIC is likely to be launched in the January-March quarter of 2022.

- The role of merchant bankers in the case of IPO is of Issue management, Promotional activities, Credit syndication, Project counseling, and Portfolio management, etc.

- The name of these merchant bankers are- Goldman Sachs (India) Securities, Citigroup Global Markets India, Nomura Financial Advisory and Securities India, SBI Capital Market, JM Financial, Axis Capital, BofA Securities, JP Morgan India, ICICI Securities, and Kotak Mahindra Capital Co Ltd.

Loans by Banks

ADB approves $112 million loan to improve water supply infrastructure in Jharkhand

- Asian Development Bank (ADB) and the Government of India have signed a USD 112 million loan to develop water supply infrastructure and strengthen capacities of urban local bodies (ULBs) for improved service delivery in four towns in the state of Jharkhand.

- This is the first project of ADB in the state of Jharkhand.

ADB approves $300 million loan to expand rural connectivity in Maharashtra

- The government of India and the Asian Development Bank (ADB) have signed a USD 300 million loan as additional financing to scale up the improvement of rural connectivity to help boost the rural economy in the state of Maharashtra.

- This is in addition to USD 200 million financing, approved by ADB in August 2019. The project is already improving and maintaining the condition and safety of 2,100 km of rural roads across Maharashtra.

Days

World Suicide Prevention Day: 10 September

- World Suicide Prevention Day (WSPD): observed on 10 September every year since 2003.

- Purpose: Provide worldwide commitment and action to prevent suicides through various activities around the world.

- 2021 Theme: “Creating hope through action”.

- The International Association for Suicide Prevention (IASP) collaborates with the World Health Organization (WHO) and the World Federation for Mental Health (WFMH) to host World Suicide Prevention Day with various activities around the world since 2003.