RBI issues revised PCA Framework for banks

- The Reserve Bank of India has issued revised Prompt Corrective Action (PCA) Framework for Scheduled Commercial Banks and it will be effective from January 1, 2022.

- Objective of PCA framework: The PCA framework enables Supervisory intervention by RBI at an appropriate time and to initiate and implement remedial measures for the scheduled commercial banks in a timely manner, so as to restore its financial health.

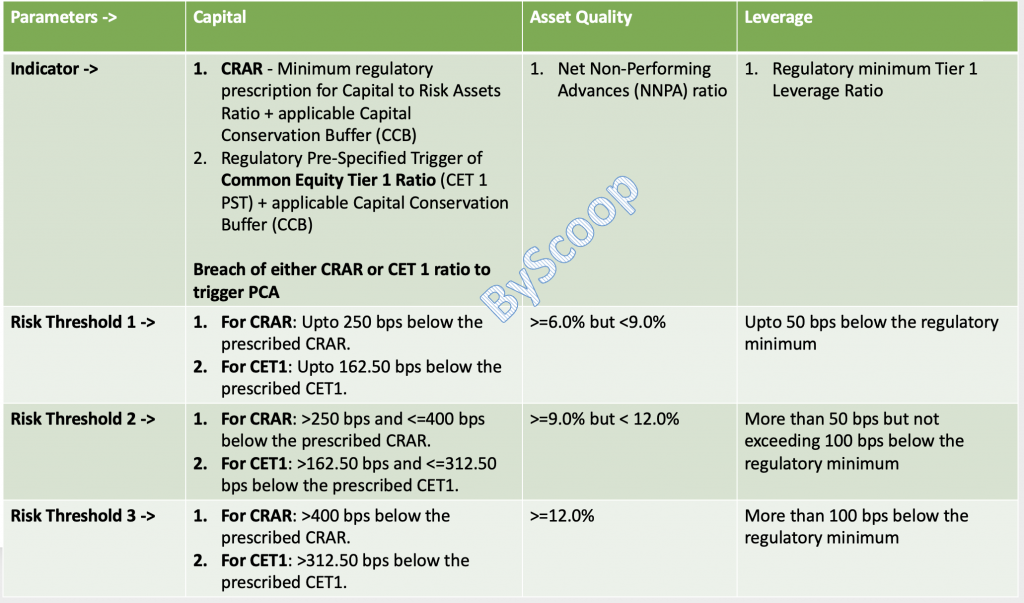

- Monitoring areas in the revised PCA framework: Capital, Asset Quality and Leverage are the key areas that will be monitored by RBI for all banks.

- Indicators to be tracked: To keep track of Capital, Asset Quality and Leverage the indicators that would be tracked are: CRAR/ Common Equity Tier I Ratio, Net NPA Ratio and Tier I Leverage Ratio respectively. i.e to track Capital of a bank RBI will see RAR/ Common Equity Tier I Ratio of the bank, to track Asset Quality of the bank, RBI will track Net NPA Ratio of the bank, similarly, to track Leverage of the bank, RBI will track Tier I Leverage Ratio of the bank.

- The threshold for these monitoring areas and parameters are given below:

- On which banks PCA will be applicable: The PCA Framework would apply to all banks operating in India including foreign banks operating through branches or subsidiaries based on breach of risk thresholds of identified indicators.

- Exit from PCA and Withdrawal of Restrictions under PCA: When a bank is placed under PCA by RBI, then withdrawal of restrictions imposed under the PCA Framework will be considered under two circumstances

- if no breaches in risk thresholds in any of the parameters are observed as per four continuous quarterly financial statements, one of which should be Audited Annual Financial Statement (subject to assessment by RBI); and

- based on Supervisory comfort of the RBI, including an assessment on sustainability of profitability of the bank.

Points to remember:

- parameters and indicators of PCA framework

- various limits

- On which banks PCA will be applicable?

Source: RBI