Roadmap for Banking of the Future

Monetary Policy Committee (MPC)

In this post, we shall study about the Monetary Policy Committee of the Reserve Bank of India, its functions, purpose and various related concepts. Before understanding about Monetary Policy Committee let us understand what is Monetary Policy.

What is Monetary Policy

- Reserve Bank of India is the Central Bank of the country. Monetary policy refers to the policy and frameworks used by the central bank to achieve a specified goal by the use of monetary instruments under its control.

- For example, in the case of India, its Central Bank i.e Reserve Bank of India uses tools like Repo Rate, Reverse Repo Rate, MSF (these are the monetary instruments) to control the inflation target (this is the main goal).

Who conducts Monetary Policy operations in India?

- The Reserve Bank of India (RBI) frames the monetary policy in India, under the provisions of the Reserve Bank of India Act, 1934.

Goals of monetary policy

- The main objective of the Monetary Policy is to maintain price stability while keeping in mind the objective of growth.

- Another objective is to keep the inflation target in control. (Inflation is a general rise in the price level of an economy over a period of time.)

Who decides the Inflation Target and What is the current inflation target?

- The Inflation target is determined by the Central Government, in consultation with the Reserve Bank of India.

- It is defined in terms of the Consumer Price Index, once in every five years.

- Central Government has decided the Inflation target for the 5-year period – April 1, 2021 to March 31, 2026 with the upper tolerance limit of 6 percent and the lower tolerance limit of 2 percent.

- This means that inflation should not go below 2% and should not go above 6%. In other words, the inflation can be in the range of 4 (+/- 2)%.

- It is the responsibility of the Reserve Bank of India, to ensure that inflation remains in this band of 2% to 6%.

- To achieve this objective Central Government constituted a committee named as Monetary Policy Committee.

- Extra: The inflation target was first set for the period August 5, 2016 to March 31, 2021.

Monetary Policy Committee

- The Monetary Policy Committee (MPC) has been constituted by the Central Government under Section 45ZB of RBI Act, 1934. It determines the policy interest rate required to achieve the inflation target.

- In simple language, we can understand that the government has formed the Monetary Policy Committee to maintain the inflation target.

Members of Monetary Policy Committee

- The Monetary Policy Committee has six members. Out of these three members are ex-officio* (and from RBI), while three other members (external members) are nominated by the Central Government from various fields. This is summarized below:

| Description | Present Occupant/s |

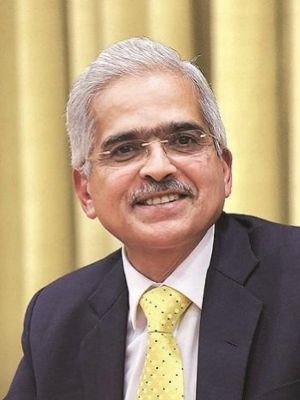

| Chairman and Member 1- Governor of RBI

He is the Chairperson of MPC, ex officio; |

Shri Shaktikanta Das |

| Member 2- Deputy Governor RBI who is in charge of Monetary Policy, ex officio; | Dr. Michael Debabrata Patra |

| Member 3- One officer of the Bank to be nominated by the Central Board, ex officio; | Dr. Mridul K. Saggar |

| Member 4, 5 and 6 i.e. the next three members are from various different fields and are selected by the Central Government (these are known as the external members of MPC)

The tenure of external members is 4 years. |

Dr. Shashanka Bhide,

Dr. Ashima Goyal and Prof. Jayanth R. Varma |

Present Members of Monetary Policy Committee (MPC)

Who appoints the external members of the Monetary Policy Committee (MPC)

- The three external members of the MPC are appointed by the Central Government on the basis of the recommendation of a six-membered Search-cum-Selection Committee headed by the Cabinet Secretary. The composition of this Search-cum-Selection Committee is:

- (a) Cabinet Secretary—Chairperson;

- (b) Governor of the Reserve Bank of India or his representative (Deputy Governor)—member;

- (c) Secretary, Department of Economic Affairs—member;

- (d) three experts in the field of economics or banking or finance or Monetary policy to be nominated by the Central Government—members

Meetings of Monetary Policy Committee

- To achieve the objective of Monetary Policy, the MPC conducts meetings. As per the RBI Act, 1934, RBI has to conduct at least four meetings of the Monetary Policy Committee in a year.

- Presently, the Monetary Policy Committee meeting is conducted once in every 2 months i.e. 6 times in a year.

- The quorum for the meeting of this Monetary Policy Committee shall be four Members. It means that the MPC meeting cannot be held if less than 4 members are present in a meeting.

- Minutes of MPC meet: The Reserve Bank of India shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee the minutes of the meeting.

Monetary Policy Report

- The Reserve Bank of India publishes a report titled Monetary Policy Report, once in every six months, that explains two main things—

- (a) the sources of inflation; and

- (b) the forecasts of inflation for the period between six to eighteen months from the date of publication of the document.

Failure to maintain inflation target

- The government has constituted the following factors as a failure to achieve the inflation target, i.e. if the following events occurs then the inflation target has been breached:

- (a) the average inflation is more than the upper tolerance level (presently 6%) of the inflation target for any three consecutive quarters; or

- (b) the average inflation is less than the lower tolerance level (presently 2%) for any three consecutive quarters.

What RBI will do when it fails to maintain Inflation Target?

- If RBI fails to meet the inflation target, it will present a report to the Central Government with the following three points–

- (a) the reasons for failure to achieve the inflation target;

- (b) remedial actions that RBI will take; and

- (c) the estimated time period within which the inflation target shall be achieved pursuant to timely implementation of proposed remedial actions.

Monetary Policy Framework

- The objective of Monetary Policy is to maintain the inflation rate within the inflation band set by the Central Government. For this, RBI has a Monetary Policy Framework. This framework aims at setting the policy (repo) rate. The repo rate is decided based on an assessment of the current and evolving macroeconomic situation; and modulation of liquidity conditions to anchor money market rates at or around the repo rate.

- The change in Repo rate gets transmitted through the money market to the entire financial system, which, in turn, influences aggregate demand which is a key determinant of inflation and growth.

Schedule of Monetary Policy Committee Meeting in 2021

- April 5 to 7, 2021

- June 2 to 4, 2021

- August 4 to 6, 2021

- October 6 to 8, 2021

- December 6 to 8, 2021

- February 7 to 9, 2022

Questions on Monetary Policy Committee

- Who frames the monetary policy framework in India?– Reserve Bank of India

- Who decides the inflation target in India?– Government of India in consultation with RBI

- Inflation in India is defined in terms of what?– CPI

- The inflation target in India is defined once in every ____ years– 5 years

- What is the present inflation target decided by the government?= 4% with a tolerance band of +/- 2% i.e upper limit of 6% and lower limit of 2%

- The Monetary Policy Committee has how many members?– 6

- Who is the chairperson of the Monetary Policy Committee?– Governor of RBI

- How many external members are there in Monetary Policy Committee?– 3

- What is the minimum number of meeting that the Monetary Policy Committee has to conduct every year?– 4

- The minutes of the Monetary Policy Committee meeting is published in how many days of the meeting?– 14 days

- What is the periodicity of the Monetary Policy Report published by RBI?– half-yearly

*ex-officio means by virtue of their post. For example, the governor of the RBI is the Chairman of MPC. Presently say Mr. A is the governor of RBI, hence Mr. A is also the Chairman of MPC because he is the Governor of RBI. Suppose tomorrow he quits as Governor of RBI, so automatically his term as Chairman of MPC will come to an end.

Attempt Quiz on Monetary Policy Committee