Credit Rating Agencies in India

In this post, we shall study Credit rating agencies and briefly about various credit rating agencies that are operating in India. Before starting the topic, let’s discuss some important terms. The most important points have been highlighted for the convenience of readers.

Credit quality– Credit quality is a measure of how likely a bond issuer is to repay its loan.

Credit rating– It is an opinion on the credit quality of a firm i.e. the ability of debt issuing firm to repay the loan or service the instrument. In short, it is an assessment of credit quality.

Definition of Credit rating as defined in “Perspectives on Financial Services” By Subhamoy Das

A credit rating may be defined as an opinion of a CRA as to the issuer’s (i.e. borrower of money) capacity to meet its financial obligations to the depositor or bondholder (i.e. lender of money) on a particular issue or type of instrument (i.e. a domestic or foreign currency: short-term or medium or long-term, etc.) in a timely manner.

Credit Rating Agency (CRA)

Definition: The rating agencies are the companies that paly the role of assessing the credit quality of any firm. They rate large-scale borrowers, whether companies or governments.

Major Role: They give ratings to a company/firm based on their ability to pay back the debt in a timely manner.

Use of this rating: The rating issued by a rating agency serves as summary information about credit quality which can then be used by economic decision-makers.

Stakeholders: There are three main stakeholders in the credit rating by CRAs, viz., issuer, investor and regulator.

Understanding CRA with example (asymmetric information)

The owner of a project who issues bonds (to borrow funds) will have more information about a project in comparison to the lender (i.e.) investor in the bonds. For investors/savers, gathering of such information is not only costly but also time-consuming. Hence a situation is created where asymmetric information is present between the issuer and investor. In a global environment, this asymmetry is even greater and the costs of collecting information is even higher. The practice of credit rating and the emergence of Credit Rating Agencies (CRAs) for the purpose is meant to help mitigate this problem of asymmetric information.

Functions of Credit Rating Agencies

- Provides superior Information

- Low-cost information

- Basis for proper risk and return

- Enhances corporate image

- Helps in the formulation of Public policy

- To reduce information asymmetry in credit markets.

History of Credit Rating Agency

- The business of credit rating started in 1909 when John Moody started rating US railroad bonds.

- The rating of corporate bonds started in the early twentieth century.

- Sovereign ratings (creditworthiness of a country) represent a relatively new line of business for the agencies. The first industrial country to be rated was France, by S&P in 1959.

- The big threes of CRA: Globally, the majority of CRA business is conducted by three credit rating agencies- (These are also known as the Big threes. )

- Moody’s (US-based),

- Standard & Poor’s (US-based) and

- Fitch (dual-headquartered in New York City and London).

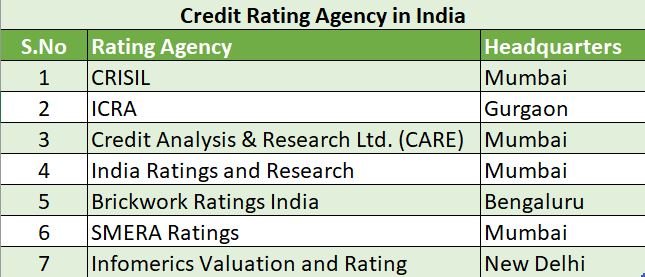

- The concept of credit rating in India started with the establishment of Credit Rating Information Services of India Limited (CRISIL) in 1987. It started functioning in 1988. Currently, seven rating agencies are registered with SEBI and are in operation in India. These are:

- CRISIL

- ICRA

- Credit Analysis & Research Ltd. (CARE)

- India Ratings and Research

- Brickwork Ratings India

- SMERA Ratings

- Infomerics Valuation and Rating

Who regulates Credit Rating Agencies in India?

The Securities and Exchange Board of India (SEBI) regulates Credit Rating Agencies in India. All credit rating agencies in India are required to register with SEBI.

Credit Rating Agency in India

As discussed, presently there are seven credit rating agencies in India that are registered with SEBI. A brief description of each is given below:

1. CRISIL (formerly Credit Rating Information Services of India Limited)

- It is India’s first credit rating agency. It was incorporated and promoted by erstwhile ICICI Ltd. in 1987. It started its operation in 1988.

- It is a subsidiary of the American company S&P Global.

- CriSidEx which is India’s first sentiment index for micro and small enterprises (MSEs) was developed jointly by CRISIL and SIDBI.

- Headquarters: Mumbai, Maharashtra

2. ICRA (formerly Investment Information and Credit Rating Agency)

- It is the second credit rating agency in India. It was established in 1991. It has 6 subsidiaries.

- It was originally named Investment Information and Credit Rating Agency of India Limited (IICRA India).

- Headquarters: Gurgaon

3. Credit Analysis & Research Ltd. (CARE)

- CARE was set up in 1993. It is the second-largest credit rating agency in India. (CRISIL being the largest).

- Headquarters: Mumbai, Maharashtra

4. India Ratings and Research

- India Ratings and Research (Ind-Ra) is a 100% owned subsidiary of the Fitch Group. Its old name is Fitch Ratings India Pvt. Ltd.

- Headquarters: Mumbai, Maharashtra

5. Brickwork Ratings India

- Brickwork Ratings (BWR) registered with SEBI in 2008.

- Brickwork Ratings has Canara Bank as its promoter and strategic partner.

- Headquarters: Bengaluru, Karnataka

6. SME Rating Agency of India (SMERA Ratings)

- It was founded in the year 2005. It was founded jointly by SIDBI, Dun & Bradstreet Information Services India Private Limited and various banks.

- Now, SMERA operates as a separate division of Acuite Ratings & Research Limited.

- Headquarters: Mumbai, Maharashtra

7. Infomerics Valuation and Rating

- Headquarters: New Delhi

Read More Banking Awareness Topics

Attempt Banking Awareness Quiz