What is National Monetisation Pipeline (NMP)

Union Minister for Finance and Corporate Affairs, Smt Nirmala Sitharaman on August 23, 2021 launched the asset monetization pipeline of Central ministries and public sector entities: ‘National Monetisation Pipeline (NMP Volumes 1 & 2)’. In this post, we will explain this National Monetisation Pipeline (NMP) in simple language.

National Infrastructure Pipeline (NIP)

Before understanding NMP we should understand NIP. All it started after the Central Government launched the National Infrastructure Pipeline (NIP) for FY 2019-25. It was an exercise to provide world-class infrastructure to citizens and improving their quality of life. The task force of NIP made several recommendations for the improvement of infrastructure in India.

National Infrastructure Pipeline (NIP) envisages an infrastructure investment of Rs 111 lakh crore over the five-year period (FY 2020-25).

Union Budget 2021-22

In line with the recommendations of the NIP task force report, Budget 2021-22 has laid out a three-pronged strategy for enhanced and sustainable infrastructure financing in the country.

- Creation of institutional structures;

- Thrust on monetisation of assets, and (this one is the basis of NATIONAL MONETISATION PIPELINE)

- Enhanced share of capital expenditure in Central and State budgets.

Hence we can see that the Monetization of Assets has been identified as one of the three pillars for enhanced and sustainable infrastructure financing in the country.

The Budget also advised the preparation of a “National Monetisation Pipeline” (NMP) to provide a direction to the monetization initiative and visibility of investors.

For this, NITI Aayog was tasked with the creation of the National Monetisation Pipeline (NMP) for brownfield core infrastructure assets. The NMP has been created to be co-terminus with the balance NIP period (2020-2025), 4 year period from FY2022 to FY2025.

What is a Brownfield asset– A brownfield investment is when a company or government entity purchases or leases existing production facilities to launch a new production activity. The opposite of brownfield investment is greenfield investment, in which a new plant is constructed.

Funding of infrastructure assets in India

It can be understood that the thrust of the government was towards the development of infrastructure in the country. For this development, a lot of funding was required. So for funding of infrastructure assets in the India, the Budget proposes the following initiatives for creating a sustainable institutional framework (From a medium to longer-term perspective)

Development Finance Institution (DFI) |

Asset Monetisation |

| Professionally managed DFI to act as provider, enabler and catalyst for infrastructure financing | Monetising operating public infrastructure assets for new infrastructure construction |

|

|

What is Asset Monetisation: Asset Monetisation, means a limited period license/ lease of an asset, owned by the government or public authority, to a private sector entity for an upfront or periodic consideration.

In simple words, the government will lend its assets to a private company for some time in return for some money.

Objective of Asset Monetisation Programme: The strategic objective of Asset Monetisation programme is to unlock the value of investments in public sector assets by tapping private sector capital and efficiencies. Which can thereafter be leveraged for augmentation/ greenfield infrastructure creation.

National Monetisation Pipeline

To ensure that this Asset Monetisation programme progress in the right direction, it is important that the Government makes available a strong pipeline of attractively structured, brownfield projects.

In simple words, NMP lists out assets and asset classes, under various infrastructure ministries, which will be monetised over a period of time.

Objectives of National Monetisation Pipeline:

- Serve as a medium-term roadmap for the line ministries and agencies

- Provide medium-term visibility to investors on infrastructure assets pipeline

- Provide a platform for ministries to track asset performance

- Bring in greater efficiency and transparency in public assets management

What shall NMP include and exclude

- Monetization through disinvestment and monetization of non-core assets (such as land, building, and pure-play real estate assets) have not been included in the NMP.

- Only core assets have been included in NMP. The core infrastructure assets covered include roads, ports, airports, telecom, railways, warehousing, energy pipelines, power generation, power transmission, hospitality and sports stadiums.

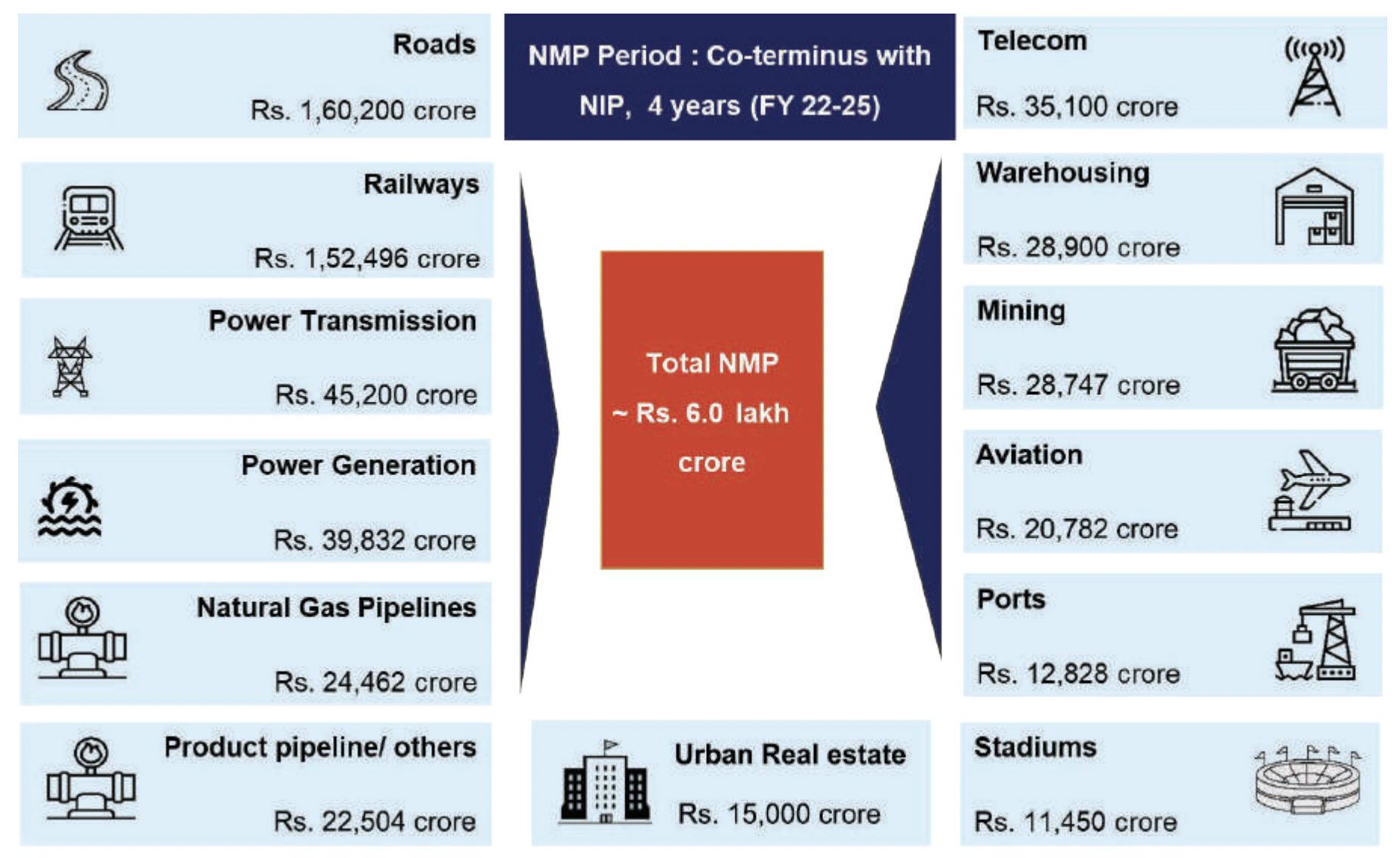

Value of National Monetisational Pipeline and sectors

The total indicative value of NMP for Core Assets of Central Government has been estimated at Rs 6.0 lakh crore over the 4 year period, FY22-25. Sector-wise Monetisation Pipeline over FY 2022-25 (Rs crore) is shown in the iamge below:

The top 5 sectors capture about 83% of the aggregate pipeline value. The top 5 sectors in NMP are:

- Roads (27%)

- Railways (25%)

- Power (15%)

- oil & gas pipelines (8%)

- Telecom (6%)

Plan for 2021-22: In terms of annual phasing by value, 15% of assets with an indicative value of Rs 0.88 lakh crore are envisaged to be rolled out in the current financial year i.e. FY 21-22.

Will the government have no power on these Brownfield Projects?

Even as significant private sector participation is being undertaken for operation and maintenance of brownfield infrastructure assets, bulk of assets continue to remain with public sector entities.

Further, under the framework for core asset monetisation, the assets monetised will be handed back at the end of transaction life.

Summary

- Government of India wanted to give its citizens world-class infrastructure and improving their quality of life. For this National Infrastructure Pipeline (NIP) for FY 2019-25 was launched.

- Now to develop infrastructre financing is required.

- In Budget 2021-22, Monetization of Assets has been identified as one of the three pillars for enhanced and sustainable infrastructure financing in the country.

- The Budget also advised the preparation of a “National Monetisation Pipeline” (NMP) to provide a direction to the monetization initiative and visibility of investors.

- For this, NITI Aayog was tasked with the creation of the National Monetisation Pipeline (NMP) for brownfield core infrastructure assets.

- What is Asset Monetisation: Asset Monetisation, means a limited period license/ lease9 of an asset, owned by the government or public authority, to a private sector entity for an upfront or periodic consideration. In simple words, the government will lend its assets to a private company for some time in return for some money.

- To ensure that this Asset Monetisation programme progress in the right direction, it is important that the Government makes available a strong pipeline of attractively structured, brownfield projects.

- In simple words, NMP lists out assets and asset classes, under various infrastructure ministries, which will be monetised over a period of time.

- The total indicative value of NMP for Core Assets of Central Government has been estimated at Rs 6.0 lakh crore over the 4 year period, FY22-25.

- The top 5 sectors in NMP are:

- Roads (27%)

- Railways (25%)

- Power (15%)

- oil & gas pipelines (8%)

- Telecom (6%)

Source: PIB